Why AI-Driven Data Center Growth Matters to Industrial OEMs

Artificial intelligence is expanding faster than any previous digital shift, and data centers are racing to keep up. Every new AI model requires more power, more cooling, and more hardware — and that surge is creating a wave of demand across the entire manufacturing supply chain. For OEMs in the electrical, automation, material movement, and equipment sectors, this growth isn’t abstract. It directly affects your timelines, your production requirements, and the partners you rely on to keep your builds moving.

As AI-driven data centers scale, they require more metal components, stronger structural frames, larger enclosures, and tighter fabrication tolerances than ever before. That means OEMs need fabrication partners who can handle complex weldments, mid- to high-volume metal runs, and fast prototyping without sacrificing consistency.

For manufacturers already juggling supply chain pressure and aggressive delivery schedules, this moment represents both challenge and opportunity. Those who secure dependable, scalable metal fabrication support will stay ahead of demand. Those who don’t will struggle to keep pace with the industry’s shift toward larger, more integrated data center infrastructure.

LMI sits in the middle of this transition — helping OEMs navigate the growth of data center metal fabrication through precise cutting, expert welding, and dependable delivery.

The AI Data Center Boom: What’s Actually Driving It?

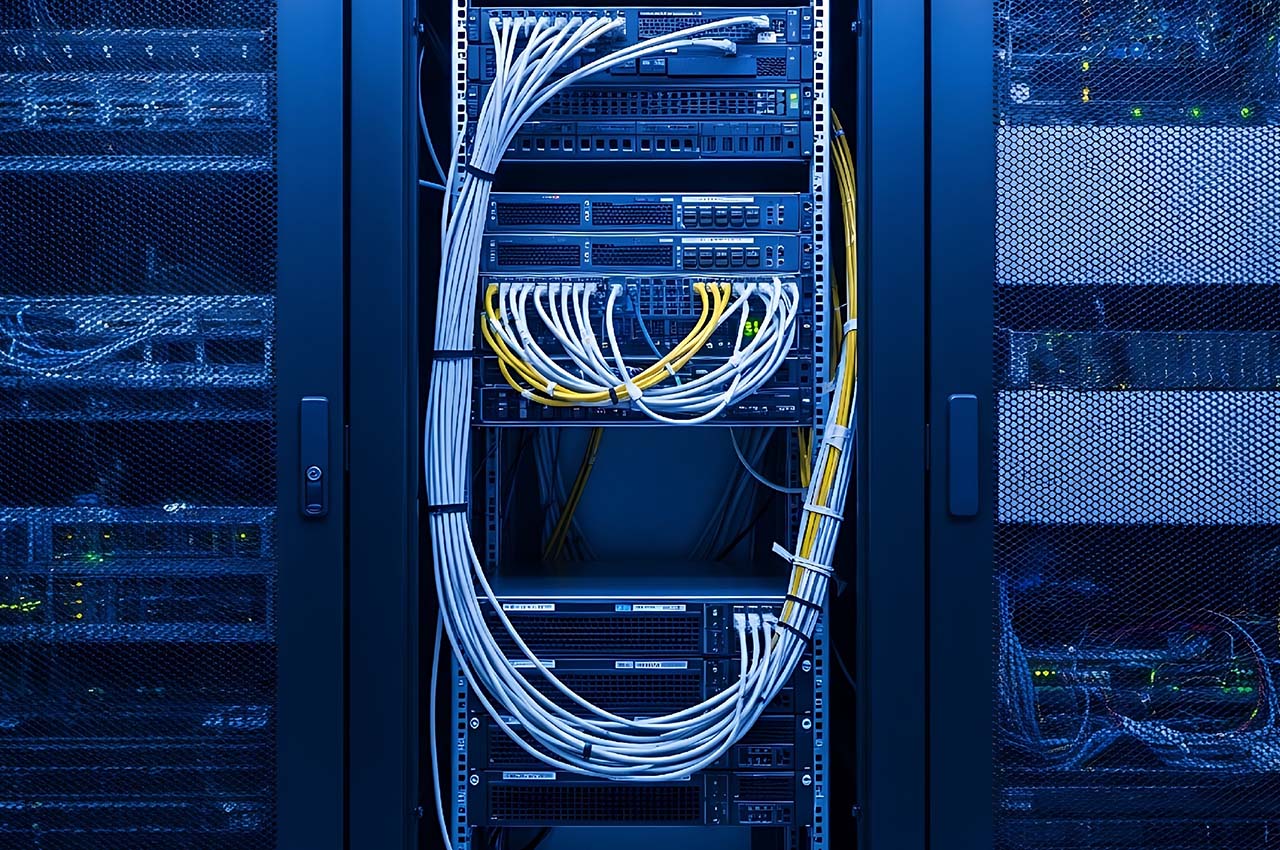

AI isn’t just increasing data center demand — it’s reshaping what these facilities need from the ground up. Traditional data centers were built around storage and networking. Today’s AI-driven centers revolve around dense, high-power computing, which places far more stress on infrastructure and the components OEMs must supply.

Below are the core drivers behind this surge and how they translate into real fabrication needs.

The Rise of High-Density, High-Power AI Hardware

AI servers run hotter, heavier, and faster than the equipment most data centers were designed for. This shifts expectations all the way down to the fabricated parts OEMs rely on.

Key infrastructure changes driven by AI hardware:

- Higher power draw ? larger, reinforced electrical housings

- Increased heat output ? more robust cooling frames, brackets, and airflow components

- Heavier equipment loads ? stronger structural assemblies and welded components

- More cables + conduit ? expanded routing trays, panels, and support structures

Fast Fact: Some industry estimates suggest AI data centers may use 3–5× more electricity per square foot than traditional centers — a ripple effect that significantly increases the need for durable metal components.

Accelerated Build Timelines Create Pressure Across the Supply Chain

Hyperscale builders and cloud providers are racing to expand capacity. That urgency moves downstream quickly.

OEMs now face:

- Shorter procurement cycles

- Compressed engineering and prototype phases

- Tighter turnaround expectations for fabricated parts

- Greater need for suppliers who can scale quickly without sacrificing consistency

This is one of the biggest shifts affecting LMI’s audience: whoever controls their fabrication bottlenecks will control their ability to win and keep data center contracts.

Bigger, More Complex Infrastructure Requirements

AI data centers are no longer simple server farms. They include:

- Substation-level power distribution systems

- High-capacity backup power units

- Advanced liquid and air cooling systems

- Modular expansion structures

- Custom enclosures with higher load requirements

Each of these areas requires precision sheet metal components, tight-tolerance forming, and structurally sound weldments — all of which increase demand for capable fabrication partners.

What This All Means for Fabricators Supporting OEMs

To keep up with AI infrastructure growth, OEMs need fabrication shops that offer:

LMI’s capabilities align directly with these evolving needs — especially in welded assemblies, large components, and fast-turn metal fabrication.

How AI Data Center Growth Impacts OEMs and Manufacturers Directly

The AI data center boom is creating opportunity across the manufacturing landscape, but it also brings real operational challenges for OEMs. As facilities grow larger and more complex, the demand placed on metal fabrication partners becomes more intense — and that pressure rolls straight onto the OEMs responsible for delivering the equipment inside those facilities.

Below are the biggest shifts OEMs are facing right now.

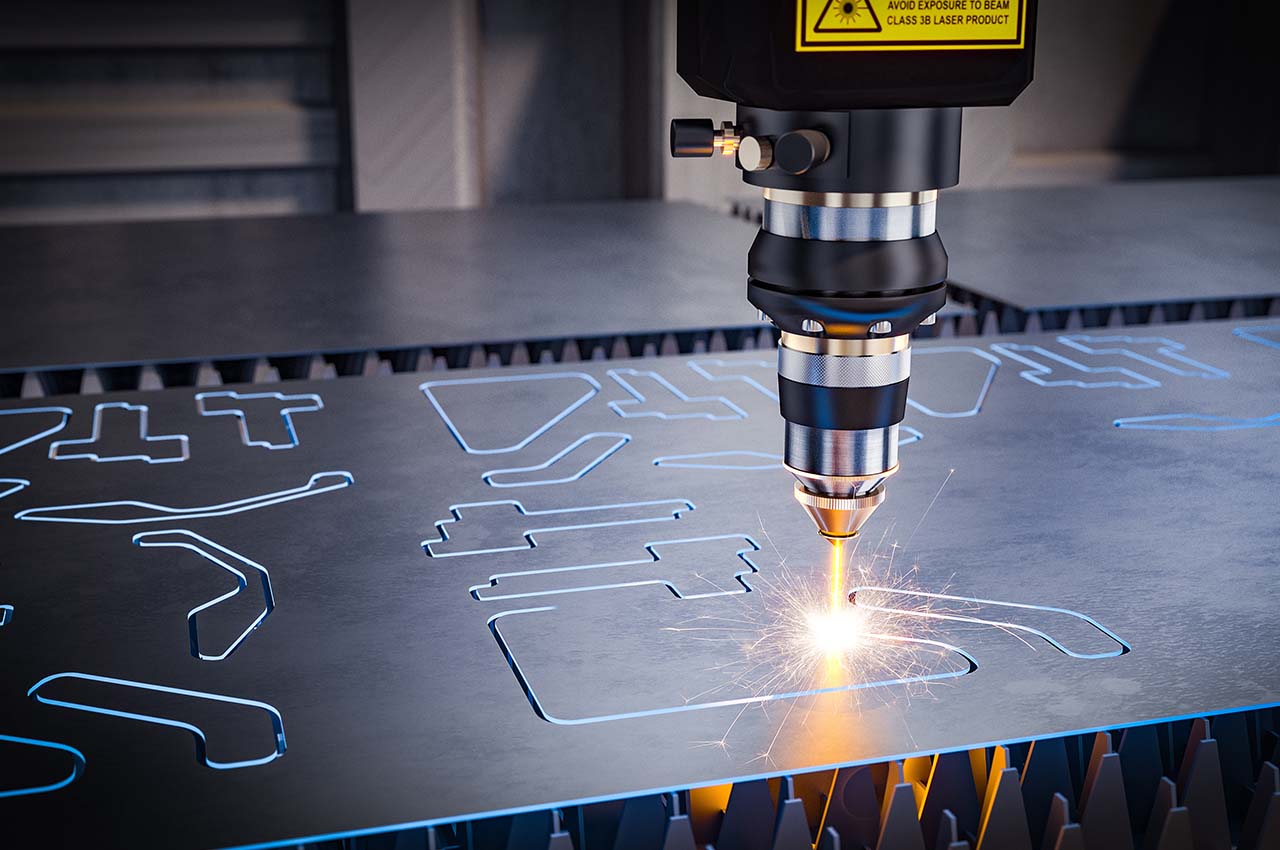

Increased Demand for Precision-Cut Sheet Metal Components

AI facilities require heavier power systems, expanded cooling structures, and more intricate hardware enclosures. That means OEMs now need:

- Tighter tolerances

- Cleaner edges and cut quality

- Fewer secondary operations

- Faster part-to-assembly workflows

For many OEMs, this eliminates shops still relying on slower CO? lasers or limited cutting beds. Large-format fiber laser capacity is becoming a basic requirement — especially for power distribution housings, rack structures, and cooling system frames.

What this means for your team: If your supplier can’t process large sheets or thick materials quickly, your assembly line feels it immediately.

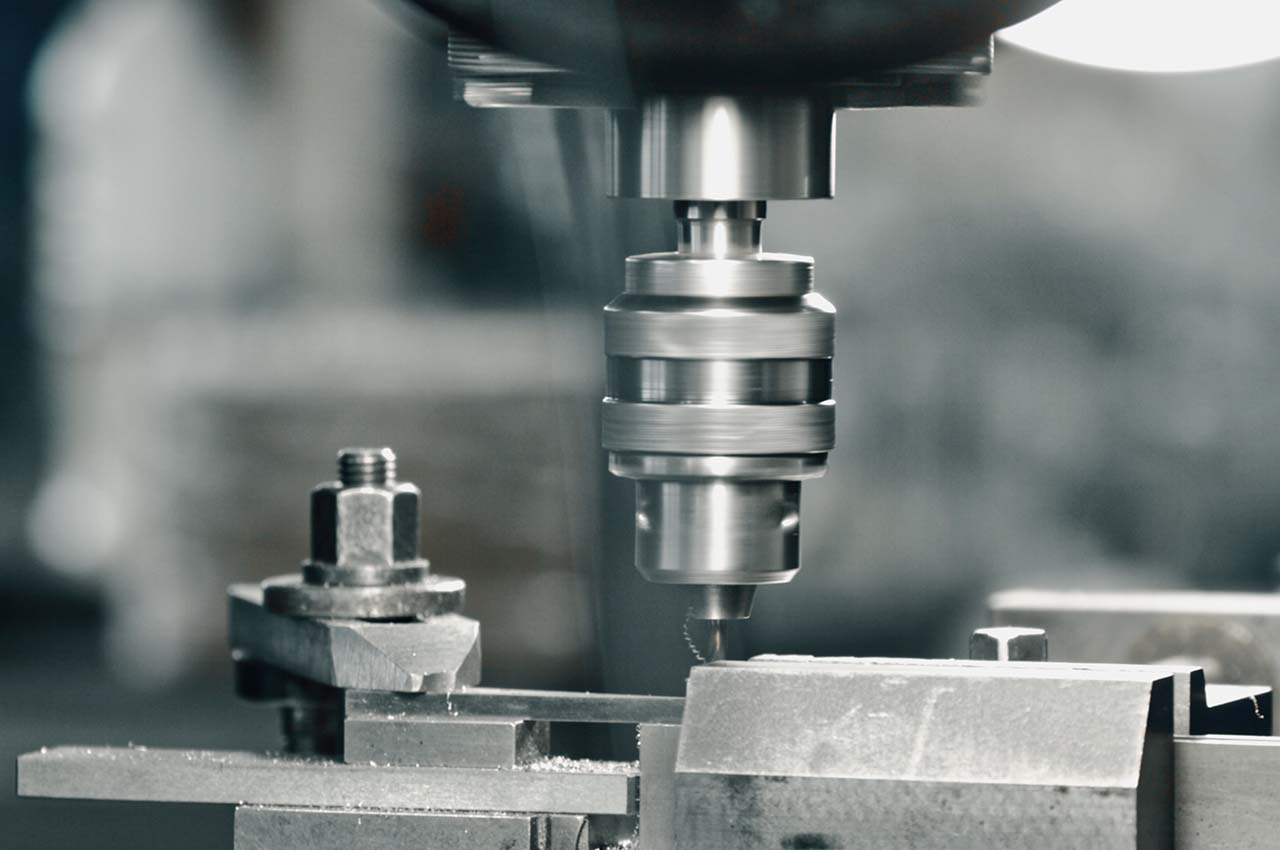

Higher Expectations for Structural Strength and Weld Quality

With AI hardware getting heavier and hotter, structural integrity matters more than ever.

OEMs are being asked to deliver components that remain rigid under vibration, thermal cycling, and constant load. This increases demand for:

- Expert welded assemblies

- Consistent weld penetration and fit-up

- AWS-qualified welding processes

- Jigs and fixtures that guarantee repeatability

- Robotic welding for high-run accuracy

For many OEMs, weld quality has become a make-or-break point for project approval.

Compressed Procurement and Development Timelines

AI data center builders are pushing to stand up new facilities in months, not years. That urgency hits OEMs long before any steel goes into the ground.

OEMs are now facing timeline pressures such as:

- Prototyping windows shrinking from weeks to days

- Purchase orders requiring rapid quoting

- Projects with rolling engineering changes

- Overlapping design, fabrication, and assembly cycles

Any fabrication delay (even a small one) cascades into major schedule issues for the entire supply chain.

OEM Risk Spotlight: Many teams now rely heavily on partners who offer quoting automation, design support, and the ability to run prototypes and production from the same floor.

Need for Fabricators Who Can Scale with You

OEMs supporting AI expansion often deal with:

- Multiple SKUs

- Repeat low–mid volume runs

- Fast-turn replenishment

- Tight revision control

- Program builds that ramp quickly

This requires fabrication partners who can grow with the program and maintain quality at every stage. Shops with fragmented processes or outsourced steps tend to struggle, slowing down OEMs who need reliable output.

Growing Pressure for Supply Chain Reliability

Electrical, automation, material handling, and cooling OEMs all share the same pain: you can’t miss deadlines when the market is scaling this fast.

To stay competitive, OEMs need fabrication partners who offer:

- In-house forming, welding, machining, and assembly

- Simple, transparent pricing

- Material sourcing agility

- Backup capacity and scheduling flexibility

- Dedicated communication and fast issue resolution

This is also where LMI’s “Champion Mentor” strength shows up — guiding OEMs toward manufacturable designs, reduced lead times, and cost-effective production approaches.

Where Metal Fabrication Fits Into the New Data Center Supply Chain

AI data centers require far more infrastructure than traditional facilities, and nearly every piece of that infrastructure starts with precision-cut, formed, and welded metal components. For OEMs building electrical systems, cooling equipment, power distribution, and material-handling solutions, this growth represents a significant opportunity — but only if their fabrication partners can keep pace.

Below are the key areas where metal fabrication plays a central role in modern AI facility buildouts.

Power Distribution Housings and Electrical Infrastructure

AI servers draw massive amounts of power, which means OEMs are delivering:

- Transformer housings

- Switchgear enclosures

- Busway components

- Conduit brackets and tray supports

- Battery and UPS enclosures

These assemblies demand tight tolerances, strong structural welds, and clean laser-cut edges to ensure proper fit-up with electrical components.

Why it matters: Even small variances can create grounding issues, access problems, or heat accumulation — all unacceptable in high-density AI environments.

Cooling System Frames, Supports, and Structural Components

AI systems generate far more heat than conventional servers. Cooling OEMs now require:

- Liquid cooling frames

- Coil and chiller brackets

- Fan assemblies

- Airflow panels and ducts

- Support structures for overhead cooling lines

These parts often include both thin-gauge sheet metal and heavier structural weldments — requiring fabricators who can pivot between fine precision and high-strength assemblies without compromising quality.

Server Racks, Cabinets, and Load-Bearing Assemblies

AI centers rely on racks that can handle more weight, more vibration, and more airflow management than older designs.

Key fabricated components include:

- Structural rack frames

- Side panels and doors

- Mounting rails

- Cable-routing accessories

- Power distribution mounting brackets

Trend Watch: As AI hardware grows in size and density, modular rack systems are becoming more popular — increasing the need for scalable, repeatable fabrication processes.

Backup Power, Generator, and Battery System Enclosures

Uninterrupted power is non-negotiable in AI operations. That creates ongoing demand for:

- Heavy-duty generator frames

- Battery rack assemblies

- Protective metal enclosures

- Vibration-resistant welded bases

- Access panels and safety guards

These pieces must withstand heat, weight, and continuous operation, making weld integrity and material consistency critical.

Material Movement, Handling, and Facility Support Components

Inside and around the data center, OEMs provide a range of equipment that depends on metal fabrication:

- Conveyor brackets and supports

- Lift-assist components

- Protective guards and barriers

- Structural bases for automation systems

Because many of these systems run 24/7, manufacturers depend on fabricators who deliver consistent performance and predictable repeatability across batches.

Fabricated Components Common in AI Data Centers

Challenges for OEMs: Supply Chain Shifts and Higher Standards

The rapid expansion of AI data centers is creating opportunity for OEMs, but it’s also raising the bar. As facilities scale, expectations are tightening around quality, delivery, and the ability to manage complexity. The result: OEMs are now facing operational challenges that traditional fabrication partners struggle to meet.

Below are the most significant pressures manufacturers are navigating today — challenges LMI is uniquely equipped to solve.

Sourcing High-Volume, Repeatable Weldments

AI-related equipment is becoming heavier, more power-dense, and more vibration-prone. That means weldments must be:

- Structurally consistent across batches

- Fit to integrate with electrical and mechanical components

- Strong enough to support higher loads

- Produced with tight process control

OEM buyers frequently cite weld inconsistency as one of the biggest reasons they switch suppliers. With data center demand increasing, repeatability is no longer a request — it’s a requirement.

OEM Insight: Weldments that vary even slightly can cause rack misalignment, cooling inefficiency, or electrical grounding issues, leading to costly field corrections.

Getting Prototypes Quickly During Fast-Moving Projects

As AI buildouts accelerate, prototyping windows have collapsed.

OEM teams are now under pressure to deliver:

- New designs with limited engineering runway

- Rapid iterations to meet evolving requirements

- Components that must move from prototype to production seamlessly

Fabricators who rely on outdated quoting systems or outsourced processes often become bottlenecks. OEMs need partners who offer:

- Quick-turn quotes

- SolidWorks-friendly file processing

- In-house cutting, forming, machining, and welding

- A design team that can support manufacturability improvements

This is where proactive guidance can save weeks. Something buyers increasingly expect from their fabrication partners.

Maintaining Consistent Quality Across Multiple SKUs

Many OEMs supporting AI projects operate with high part variety, low–mid volume runs, and tight schedules. Managing this mix is difficult without strong internal processes.

Typical issues OEMs face:

- Variation between runs

- Lost time to improper fit-ups

- Material inconsistencies

- Lack of fixture control

- Delays from shops that outsource key steps

In an environment where data centers are operating at full capacity, inconsistent fabrication quickly becomes a major liability.

Avoiding Delays Caused by Limited Shop Capabilities

Not all fabrication shops can handle the demands of AI-focused OEM work. The limitations often show up as:

- Cutting beds too small for large housings

- Inability to process thicker material cleanly

- Minimal welding bench strength

- No robotic welding capabilities

- Outsourced machining, forming, or finishing

- Slow response times due to manual quoting or scheduling

For OEMs under pressure, choosing the wrong shop can cost weeks.

What OEMs Needed 5 Years Ago vs. What They Need Now

OEMs who adapt to these new expectations and align with fabrication partners who can meet them, positioning themselves to win long-term data center programs.

What the Data Center Surge Means for Fabricators Like LMI

As AI-driven data center construction accelerates, the fabrication industry is being pushed into a new era of expectations. Fabricators that once focused on simple cutting and forming must now deliver higher precision, stronger weldments, and faster, more scalable production. OEMs need suppliers who can move from prototype to production without disruption and who can support increasingly complex assemblies.

Below are the capabilities today’s fabricators must excel in, and how LMI is already aligned with these demands.

Advanced Fiber Laser Cutting for Larger, More Complex Parts

AI facilities rely on oversized housings, cooling frames, and heavy electrical components that often exceed the cutting capacity of older equipment.

Why fiber laser capacity now matters:

- Faster cutting speeds on thick and thin materials

- Cleaner edges that eliminate secondary processing

- Greater precision for tight-tolerance assemblies

- Large-bed capability for bigger parts (79” × 158”)

LMI’s 6kW fiber laser allows OEMs to consolidate cuts, reduce scrap, and accelerate assembly — critical benefits when timelines are compressed.

The Rising Demand for High-Strength Welded Assemblies

With heavier hardware and larger loads, weld integrity has become a priority across AI infrastructure projects.

Fabricators must deliver:

- Strong, uniform welds with minimal distortion

- AWS-qualified welding processes

- Fixtures designed for repeatability

- The ability to handle weldments with dozens of components

- Robotic welding for consistency at scale

Where LMI excels:

- Deep bench of welding talent

- Expertise in large and complex weldments

- Robotic welding for predictable, repeatable output

- Ability to assist with weld design or manufacturability improvements

In a market where weld quality is a differentiator, LMI’s welding expertise becomes a significant advantage for OEMs.

The Need for In-House Forming, Machining, and Assembly

AI buildouts require more than just cut parts. OEMs need partners who can deliver complete, production-ready assemblies — not just components.

Fabricators who thrive in this market offer:

- In-house press brake forming

- Tube and small roll forming

- Machining and tapping

- Assembly and finishing coordination

- Controlled workflow without handoffs to multiple vendors

Because LMI handles nearly every process under one roof, OEMs benefit from reduced lead time, fewer errors, and consistent quality across every stage.

The Shift Toward Prototyping + Production on the Same Floor

Data center programs often begin with rapid prototypes that quickly evolve into repeat builds. Fabricators must handle that transition seamlessly.

LMI meets this need through:

- Fast quoting supported by modern file-processing systems

- Ability to accept SolidWorks models for quick turnaround

- Design support to improve manufacturability

- Smooth ramp from prototype to mid- or high-volume runs

This reduces downtime between concept and production. A major advantage when OEMs are under competitive pressure.

Why Integrated Fabrication Matters More Than Ever

The more steps that happen in-house, the fewer delays OEMs face. AI expansion has exposed the weaknesses of fragmented supply chains, making integrated fabrication a strategic priority.

Integrated Fabrication Advantage: One shop controlling laser cutting, forming, welding, machining, and assembly means fewer scheduling gaps, faster adjustments, and greater consistency.

For OEMs trying to serve the AI sector, this is no longer optional — it’s a competitive requirement.

How LMI Helps OEMs Stay Competitive in the New Era

As AI data center infrastructure expands, OEMs are under pressure to deliver high-quality components faster and more reliably than ever. LMI helps manufacturers stay ahead by combining advanced technology with experienced craftsmanship and a collaborative, solutions-driven approach. When projects become complex, timelines tighten, or production volumes shift unexpectedly, LMI steps in as both a fabrication partner and a trusted advisor.

Below are the specific ways LMI supports OEMs during this industry shift.

Faster Quoting and Rapid Prototyping

OEMs can’t afford delays during early design stages. LMI’s modern quoting system and SolidWorks-friendly workflows ensure fast turnaround — often within two business days.

What this means for your team:

- Quotes delivered quickly and accurately

- Prototypes accelerated to support tight development cycles

- Ability to iterate rapidly without losing production time

- Early manufacturability insights that prevent rework

Design Support That Improves Manufacturability and Reduces Costs

Many OEMs know what they need their assembly to do — but not always the best way to fabricate it. LMI’s engineers help refine designs before production so you get the outcomes you expect without unnecessary spend.

This collaboration increases efficiency and strengthens the final product, especially important for data center components that must withstand heavy loads and continuous operation.

Expertise in Large, Complex Weldments

Welded assemblies represent 50–60% of LMI’s work, and the team has one of the strongest welding benches in the region.

Capabilities OEMs rely on:

- AWS-qualified welding

- Complex assemblies with 20–30+ components

- Robotic welding for high-run repeatability

- Fixtures that ensure consistent alignment

- Ability to interpret partial or incomplete prints

LMI’s welding team consistently earns praise for producing the best-quality weldments many OEMs have ever received — a result of decades of experience and strict process control.

Production Scalability for Mid- and High-Volume Runs

As data center programs grow, OEMs need suppliers who can scale production without losing quality. LMI is designed for exactly that.

You benefit from:

- A 40,000 sq. ft. production floor

- Large-bed fiber laser cutting

- Extensive press brake tooling

- Robotic and manual welding capacity

- Ability to manage high SKU counts

- Smooth transition from prototype to production

Whether you need repeat shipments each month or a ramp-up for a new program, LMI adjusts to your demand without compromising timelines.

Transparent Pricing and Reliable Communication

AI expansion demands predictable schedules and clear cost structures. LMI supports OEMs with:

- Straightforward, upfront pricing

- No hidden charges or unclear line items

- Clear schedules and realistic lead times

- Proactive communication throughout each project

OEM Confidence: When you work with LMI, you know what you’re getting, when you’re getting it, and how much it costs — every time.

One Partner for Cutting, Forming, Welding, Machining, and Assembly

With nearly every major process under one roof, LMI eliminates the delays and inconsistencies that come from juggling multiple vendors.

Integrated services OEMs depend on:

- Fiber laser cutting

- Turret punching

- Press brake forming

- Tube bending

- Welding (manual + robotic)

- Machining

- Assembly

- Finishing coordination

This approach strengthens quality control, accelerates delivery, and reduces the number of touchpoints your team must manage.

What’s Next: The Long-Term Impact of AI on Manufacturers

AI isn’t a temporary surge — it’s a structural shift shaping how data centers, OEMs, and fabrication partners will operate for years to come. As facilities increase in size, density, and complexity, manufacturers that support these environments will need deeper technical capability, faster response times, and fabrication partners who can evolve alongside changing requirements.

Here’s what OEMs can expect in the next wave of AI expansion.

Growth of Modular and Prefabricated Data Center Structures

Modular data centers and prefabricated power/cooling assemblies are becoming mainstream as hyperscale builders seek faster build cycles.

How this trend affects OEMs:

- More emphasis on large, welded assemblies

- Greater need for tight tolerances on interlocking parts

- Increased use of repeatable SKUs across multiple facilities

- Higher demand for prototypes that quickly transition into production runs

Fabricators with strong assembly capability and repeatability, like LMI, become critical partners in modular growth.

More Demand for Lightweight, High-Strength Components

To handle higher power density without increasing footprint, AI data centers are shifting toward lighter but stronger structures.

This drives demand for:

- Precision-formed sheet metal components

- Structural assemblies with controlled weld distortion

- Components designed for airflow optimization

- Material-efficient parts that reduce weight without compromising strength

OEMs will lean on fabrication partners who can balance manufacturability with performance requirements.

Increasing Use of Automation and Robotic Welding

As project timelines shrink, the industry will continue pushing toward automation.

Why automation matters long-term:

- Ensures consistent weld quality across large runs

- Reduces variability between batches

- Increases production speed

- Improves cost control for OEMs

- Allows for predictable scaling across multi-facility programs

Fabricators with robotic welding already in place are positioned to meet future volume and consistency demands.

Continued Pressure on Lead Times and Supply Chain Reliability

AI expansion has exposed weak points in global supply chains. Moving forward, OEMs will prioritize partners who offer:

- In-house cutting, forming, welding, machining, and assembly

- Reliable material sourcing

- Faster quoting and clearer communication

- Strong bench depth to meet growing production schedules

- Proven consistency across high SKU counts and mid–high volume runs

Supply chain confidence will continue to influence which OEMs win long-term programs.

The Increasing Value of Fabrication Partners Who Can Guide, Not Just Produce

As data center components become more complex, OEMs will need more than production capacity — they’ll need mentorship and engineering support.

Fabricators that thrive in the AI era will offer:

- Design-for-manufacturability insights

- Early involvement in engineering discussions

- Problem-solving support for complex assemblies

- Prototyping that anticipates production requirements

- Transparent, collaborative communication

The Mentor Edge: OEMs partnering with shops that provide guidance — not just parts — will gain speed, reduce cost, and improve reliability in every build.

What This Means for OEMs Moving Forward

Expect:

- More pressure

- More competition

- More demand

And the OEMs who succeed will be the ones who:

- Strengthen their supply chain now

- Partner with fabricators who can scale with them

- Lean on trusted experts who bring clarity, speed, and precision

LMI’s blend of experience, advanced technology, and collaborative engineering support positions OEMs to stay competitive as AI continues reshaping the manufacturing landscape.

Why Now Is the Time to Strengthen Your Fabrication Supply Chain

AI’s expansion is transforming the scale and complexity of modern data centers — and that shift is reshaping what OEMs need from their fabrication partners. Stronger weldments, cleaner laser-cut components, tighter tolerances, faster prototyping, and more reliable delivery aren’t optional anymore. They’re the new baseline for manufacturers competing in a market where speed and precision determine who wins the next program.

As these demands increase, OEMs need partners who combine advanced technology with deep experience and collaborative support. LMI helps manufacturers navigate this new era with fiber laser accuracy, robust welding expertise, integrated fabrication processes, and transparent communication that keeps projects moving without surprises.

If your team is preparing for upcoming data center projects — or if you’re looking to improve the consistency, quality, or speed of your metal components — this is the moment to reinforce your supply chain with a partner who’s ready to scale with you.

Let’s strengthen your next build together.

LMI is here to support your prototypes, production runs, and complex assemblies with the precision, reliability, and guidance your team needs to stay ahead.

Ready to see the difference an ISO-certified fabrication partner can make?

Let’s make something better - together.